More Family Law Profits Web-Based Application’s Unique Capabilities With Helpful Instructions

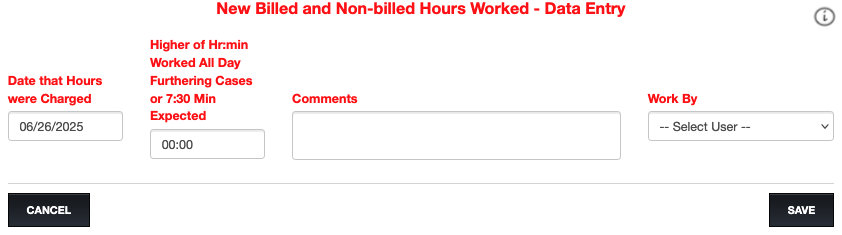

New Hours Worked

Click Here to see More Family Law Profits Application’s Unique Capabilities With Helpful Instructions.

The More Family Law Profits “Hours Worked” form takes Legal staffers about 1 minute a day, then subsequent “Hours Worked” reports can help guide them and help remind them to bill, to bill more efficiently, and to perhaps bill more aggressively by tracking and displaying their Hours Worked furthering cases, Hours Billed, and Billing Efficiency.

- Legal Staff should make entries each evening while memories are fresh, just after entering all daily Charges. As an alternative, staff can make new Hours Worked entries for past days that Charges were entered, but entries must be made in the proper date order and before making new Charges for each day.

- If a Staffer delays entering charges and somehow seems locked out of entering Charges and/or entering Hours Worked, he/she probably skipped a date entering Hours Worked. Look at Hours Worked entries for the last few days, and probably the last one needs its date edited. Under “Options” on the rightmost column, select “Edit” and decreasing the date by one day or what seems appropriate may work. Otherwise, ask an Administrator to help by deleting and re-doing “Hours Worked” entries in the proper date order.

- If you delayed entering charges that you want to enter for more than 1 previous date: enter or ensure you have entered Hours Worked for the last date Charges were entered, then:

a. Enter next date’s Charges

b. Enter Hours Worked for that date’s Charges

c. Repeat steps “a” and “b” as necessary to catch up. When you enter“ New Hours Worked”, you cannot enter a number lower than the hours charged. But if you enter additional charges for a prior day when you already entered charges, then “Hours Worked” could erroneously show that you billed more hours than you worked. If that happens, on that entry on “Hours Worked”, “Edit” and increase Column D to the same value shown in Column F, or if necessary ask an Administrator to do it. Editing prior Hours Worked entries on the Hours Worked form is not allowed by legal staff after 3 days. If that becomes necessary, ask an Administrator to do it.

Creative methods for legal staff to improve Column F “% of Worked”:

- For weekdays, when you add “New Hours Worked”, you cannot enter a number that is below 7:30, but when you charge > 7:30 hours, you can enter the actual hours charged instead of a higher number that you may have actually worked.

- For Saturdays or Sundays, when you “Add New Hours Worked”, you can enter a number that is below 7:30, and you can enter the actual hours charged instead of a higher number that you may have actually worked.

- If you work > 7:30 on a holiday that is also a weekday, when you “Add New Hours Worked”, you can enter the actual hours charged instead of a higher number that you may have actually worked.

- If you work < 7:30 on a holiday that is also a weekday, you may bill it as if you worked it on the next weekday, and you can add client notes on the charges explaining that the work was done on the holiday date.

- For vacation, sick, or personal weekdays that you were expecting to be taking off, if you entered charges < 01:00 hour, you may bill it as if you worked it on the next weekday, and you can add client notes on the charges explaining that the work was actually done on a vacation day.

Thank you, More Family Law Profits team member. You deserve More Family Law Profits and More Family Law Profits loves helping you.